Australian rare earths miner Lynas Corp (ASX: LYC) and

its United States-based partner Blue Line Corporation are fine-tuning funding

plans to build a rare earths plant in Hondo, Texas.

Lynas, which controls just over 10% of the global rare

earths market, signed in May a memorandum of understanding with Texas-based

Blue Line to set up a rare earths separation facility in the south-central state.

Funding details are expected to be unveiled by the end of February, chairman Mark Harding said at the company’s general meeting held on Tuesday.

“We are in various different negotiations with respect to funding and offtake for that plant. We do expect to have more announcements on that sometime in the next two to three months,” chief executive Amanda Lacaze said.

The US has stepped up efforts to ensure the supply of the critical minerals from outside China, which currently accounts for 70% of the world’s production

The facility would be the world’s only large-scale producer

of separated medium and heavy rare earth products outside of China, which currently accounts for 70% of global production. Beijing also controls

90% of a $4 billion global market for materials used in magnets and motors that

power phones, wind turbines, electric vehicles and military devices.

Lynas, the only major rare earths producer outside China,

currently ships the ore it mines in Western Australia to its processing plant

in Malaysia. The facility not only does not have heavy rare earths separating

capacity, but also continues to face challenges rooted in concerns expressed by

the Malaysian government over low-level radioactive waste produced at the plant.

The company’s six-year-old facility in the country — known

as the Lynas Advance Material Plant (LAMP) — has been the cause of ongoing

tension between Kuala Lumpur and the Sydney-based miner.

LAMP was the centre of relentless attacks from environmental

groups and local residents while under construction in 2012. They feared about

the impact the low-level radioactive waste the refinery generates could

have on the health of those living nearby, and to the environment.

Scrutiny escalated last year, with the Malaysian government setting a committee to review Lynas’ operations. Lacaze raised concerns about the impartiality of a couple of committee members, as both are known for being long time opponents of having the refinery located in Malaysia.

In December, the country ordered Lynas to remove 450,000 tonnes of radioactive

waste stockpiled at its processing plant by Sept. 2., when the

company’s licence was up for renewal.

The miner was granted six-month licence renewal — shorter than the usual 3 years — under a number of conditions, including identifying Malaysia-approved site for a permanent disposal of low-level radioactive waste Lynas generates. Alternatively, the company would have to secure official written approval from a recipient country willing to take the waste, said the country’s Atomic Energy Licensing Board (AELB), an agency under the Ministry of Energy, Science, Technology, Environment and Climate Change.

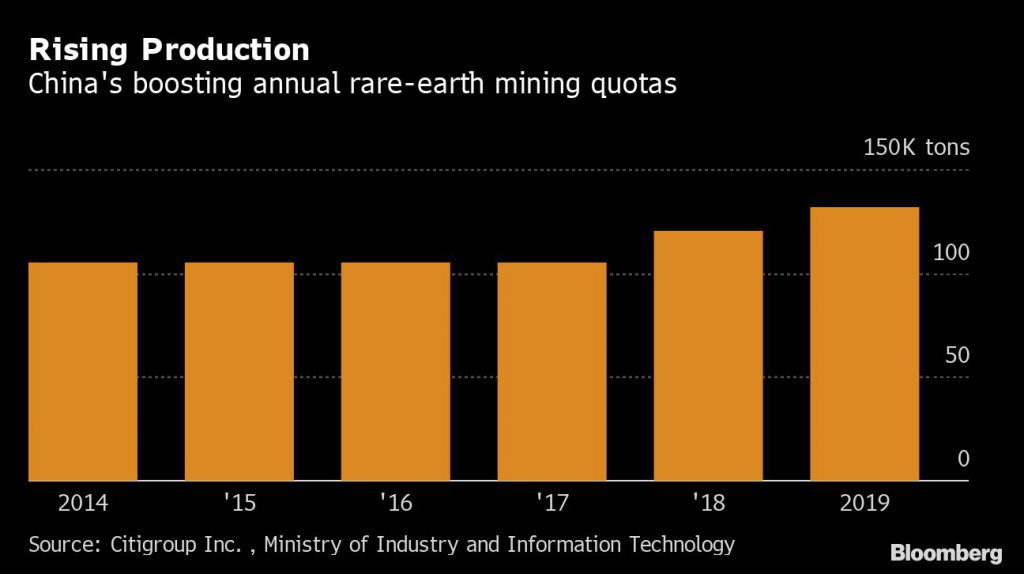

With Washington and Beijing locked in trade talks, there were fears that China may restrict access to the materials. Instead, the nation has been bulking up, threatening efforts in the US and elsewhere to undercut the Asian giant’s dominance in the rare earths market.

Last year, the world’s second largest economy produced about

120,000 tonnes of rare earths, while the totals of the next two leading

producers — Australia and the US — were 20,000 and 15,000 respectively.

Not so rare

Despite their name, the 17 minerals grouped under the rare

earths label are not rare. According to the US Geological Survey (USGS), they

are roughly as common as copper. But, because rare earth ores oxidize quickly,

extracting them is both difficult and extremely polluting.

In the past three months, The Trump administration has stepped up efforts to ensure the supply of critical minerals from

outside China. As part of those initiatives, it recently signed a memorandum of

understanding with Greenland to conduct a hyper-spectral survey to map the

country’s geology.

Washington has also gained the support of Australia, which has committed to facilitate potential joint ventures to improve rare earth processing capacity and reduce reliance on Chinese rare earths. The mineral agencies of the both countries signed last week a research agreement to quantify their reserves of critical mineral reserves.