Sirius Minerals (LON:SXX), the British junior struggling to build a huge fertilizer mine beneath the North Yorks Moors national park, has set up the timetable for Anglo American’s £405 million (about $524m) planned takeover and opened a helpline to explain to shareholders why they should accept it.

“There is no alternative,” the miner said in a statement. “If the acquisition is not approved by shareholders and does not complete there is a high probability that the Sirius board will place the business into administration or liquidation.”

Shareholders will vote on whether or not to accept Anglo’s lifeline on March 3. At the peak, around 85,000 individual private investors had shares in the Yorkshire mine developer, and most of them were believed to be either first time or fairly inexperienced investors.

Sirius said shareholders could call the helpline (0371 664 0321 or 00 800 3742 6163) if they had questions about the offer documents, the pending court meeting, general meeting, or how to complete proxy voting forms.

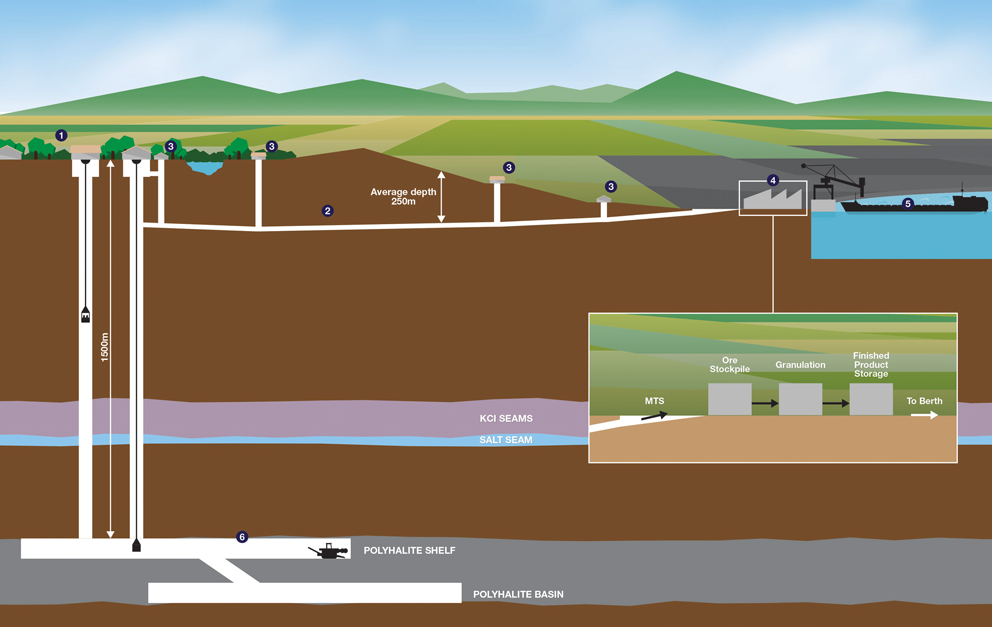

The $3.8bn Woodsmith project is expected to produce around 10 million tonnes per year of polyhalite, a form of potash used in plant fertilizers

Jupiter Asset Management, which controls about 7.8% of Sirius shares, recently urged the company’s board to explore a rival approach. According to Jupiter, a consortium of financial investors is offering $680 million of debt-based funding, which is a proposal that “would enable shareholders to remain invested in the project.”

Sirius has repeatedly recommended the Anglo takeover as the “only feasible option,” and believes the alternative bid is “not acceptable” as it would have required the company to “undertake a substantial new equity-raising.”

Anglo’s offer of 5.5p a share is equivalent to one-third more than the targeted company’s market value the day before the proposed takeover was made public.

Sirius was worth more than $2.3 billion 18 months ago, before its funding plans failed.

The firm, which is midway through building its Woodsmith fertilizer mine, has seen its share price collapse after warning last September that multi-billion dollar funding for the next stage had fallen through. It warned at the time it only had enough cash to last another six months.

The company has already raised £920

million ($1.2bn) to develop Woodsmith and received the backing of thousands of

local retail investors, but needs a further $3.8bn to turn it into the world’s

biggest producer of polyhalite, a multi-nutrient fertilizer.

As a last resource, Sirius launched in November a rescue plan involving the participation of a potential strategic investor and a revised two-stage development plan for the mine.

Anglo seems to be just what Sirius has been waiting for. The British junior said it was prepared to recommend the offer provided it can secure satisfactory assurances around jobs and stakeholder interests.

If the deal goes ahead, if could

save more than 1,000 jobs in one of England’s most underprivileged areas, which

goes hand in hand with Prime Minister Boris Johnson’s pledge to revive poorer

regions of the UK.

Long time coming

Anglo American, which is looking to retreat from thermal coal, hinted the

unexpected bid had been in the works for months. It noted it identified the project

as being of potential interest “some time ago” due to its quality in terms of

scale, resources and costs.

“We are unashamedly transitioning our portfolio to later cycle products that we believe the world will need as it goes forward,” chief financial officer, Stephen Pearce, said on a call last month.

If successful, the takeover would

mark a comeback to the fertilizer sector for Anglo, which owned some phosphate

assets in the past but in recent years has focused on “four pillars” — copper,

iron ore, diamonds and platinum.

It would also add a second major

project to Anglo’s $5bn Quellaveco copper mine in Peru, at a time when

most rivals are reluctant to expand.

“We fundamentally believe part of

our responsibility is to keep an eye on growth over all the aspects of

different time frames,” Pearce added.

Analysts, such as Humphrey Knight,

senior potash analyst at CRU, consider Anglo’s move risky.

“Sirius’ planned production is around 30 times larger than the total polyhalite market size in 2018. The company plans to rapidly increase production to over 10 million tonnes only a few years after starting operations, which adds to concerns of significant disruption to wider fertilizer markets — even with its numerous offtake agreements,” Knight told MINING.COM in September.

He noted that the underlying uncertainties around polyhalite, including potential market size and pricing, remain.

Sven Reinke, senior vice president

and lead analyst for Anglo American at Moody’s Investor Service, believes that

a successful acquisition of Sirius would increase Anglo’s financial risk

profile for a number of years.

Tens of thousands of individual private shareholders invested in the British miner and many may be unfamiliar with the regulatory processes in the completion of a takeover

“This is driven by the very

material capital investment needed over the next few years to complete the

Sirius polyhalite mining project,” Reinke wrote.

Ed Sterck, metals & mining

analyst at BMO Capital Markets, believes that while there are question marks

over the nearer-term demand for POLY4, Anglo American is clearly attracted to

the scale of the project.

“This would certainly be a

counter-cyclical investment (for the fertilizer market), but given the

extremely long mine life this may present an interesting opportunity in a

‘green’ commodity over the longer term,” Sterck wrote in January.

BMO expects the potash to remain in

oversupply until 2027, meaning that the near-term take-up of what it calls a

“commercially unproven alternative” may be limited.

The Woodsmith mine, poised to be

one of the world’s largest in terms of the amount of resources extracted,

is set to generate an initial 10 million tonnes per year of polyhalite, which

contains four of the six key elements needed for plant growth (potassium,

sulphur, magnesium and calcium).

Bank of America Corp. and

Centerview Partners U.K. LLP are the joint financial advisers to Anglo

American, while JPMorgan is advising Sirius Minerals.