Chile’s Codelco, the world’s No. 1 copper producer, is closer

to securing a long-awaited deal with Ecuador-controlled miner Enami EP, which

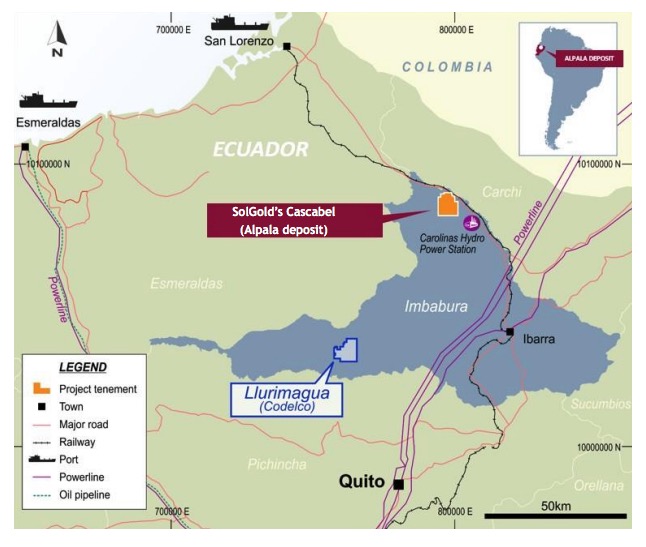

will allow them to jointly develop a massive project located about 80 km

northeast of the country’s capital, Quito.

The 982-million-tonne Llurimagua copper project, in the northern

Imbabura Province, is in the advanced exploration stage and could become the

first mine the Chilean giant operates abroad.

Construction should begin shortly after the board of Llurimagua Copper Company S.A., the 51%-49% joint venture between Codelco and Enami, approves the agreement that formalizes the entity.

The 982-million-tonne Llurimagua copper project is located in the Imbabura Province, about 80 km northeast of Ecuador’s capital, Quito

That announcement, local paper El Mercurio reports, is expected to come this week.

Codelco and Enami first signed a cooperation agreement about a decade ago, but the companies only began talking about Llurimagua in 2015.

According to Ecuador’s vice minister of mining Fernando Benalcázar, the project is one of the copper industry’s “crown jewels,” but its development has faced challenges, including intermittent resistance from nearby communities over environmental concerns.

“Having this deposit in our soil and partnering with the world’s number one copper company, opens the doors for development technology, employment opportunities and economic growth. This project can change the lives of Chileans and Ecuadorians,” Benalcázar said earlier this month.

“Today, the Llurimagua deposit is completely different than in 2015. The Junín target lead us to discover 1km continued mineralization,” Codelco’s exploration team leader, Angelo Aguilar, added.

Construction at Llurimagua is expected to take up to four

years. Once at full tilt, the mine is expected to churn out 210,000 tonnes of

copper annually over a 27-year productive life.

To date, the miner has spent about $40 million in exploration and plans to invest another $3 million by 2021. From that figure, $131 million will be designated to Llurimagua.

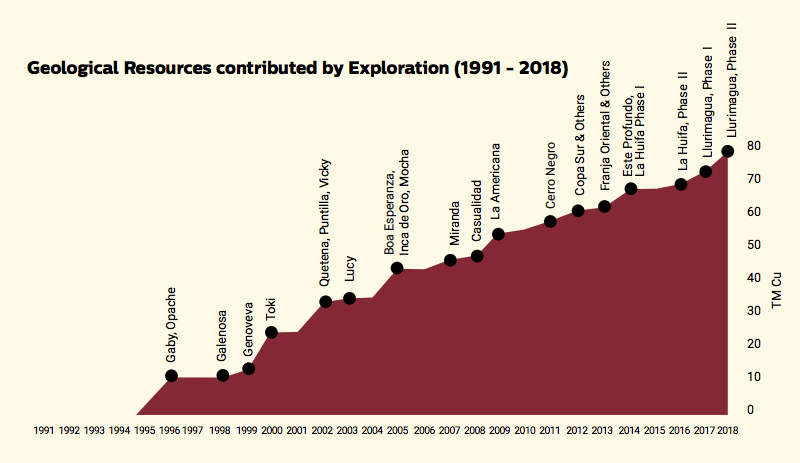

From Hotspot to Producer

Ecuador, the new darling of copper prospectors, expects

to attract $3.7 billion in mining investments over the next two years, up

significantly from the $270 million it received in 2018.

The country is moving forward with plans to move from an explorers hotspot to mining exporter as its only large-scale copper mine readies to ship its first large cargo this month.

The $1.4 billion Mirador open-pit mine, owned by a joint

venture of Tongling Nonferrous Metals Group and China Railway Construction

(EcuaCorriente), opened in July, but has turned out to be a “headache for the

government,” Benalcázar said in a presentation in Chile’s capital Santiago last

week.

The authority said the copper-gold mine has been suspended three times since construction due to workers’ safety issues. “For the operators, safety is not a priority and we had to make big efforts to tell them that Ecuador has rules to follow,” he said.

Canada’s Lundin Gold (TSX:LUG), which has been developing its Fruta del Norte gold-silver project for almost two years, has produced its first doré and gold concentrate, and is on track to beginning commercial activities in the second quarter of 2020.

Other than Llurimagua, another two major copper projects are due to be in production by 2024: SolGold’s (LON, TSX:SOLG) Cascabel and Lumina Gold’s (TSX-V:LUM) (OTC:LUMAF) Cangrejos.