Zijin Mining, China’s No.1 gold producer, is buying Canadian miner Continental Gold (TSX: CNL) for almost C$1.4 billion ($1bn), in a move aimed at increasing the company’s bullion reserves and boosting cash flow as well as profit.

The mining giant offered C$5.50 a share in cash, a premium to Friday’s close price of C$4.87, in a friendly deal that gives it access to Continental’s main asset — the Buriticá gold project in Colombia.

Buriticá, in north-western Colombia, has measured and indicated gold reserves of 165.47 tonnes and an inferred reserve of 187.24 tonnes. Expected to begin operations next year, the mine will churn out 250,000 ounces of gold per annum on average over a 14-year productive life.

Zijin said the acquisition of Continental boosts its gold reserves to more than 2,000 tonnes, with output growing by nearly 20%.

With the acquisition, Zijin boosts gold reserves to more than 2,000 tonnes, with output growing by nearly 20%

“[Buriticá] is one of the largest and highest-grade gold projects in the world and represents a highly complementary addition to Zijin’s international asset portfolio,” chairman Chen Jinghe said in the statement.

The Chinese gold, copper and zinc miner has been

expanding its footprint by acquiring assets from Africa to Australia.

In November, Zijin announced it was buying partner Freeport McMoran’s copper-gold assets in Serbia for up to $390 million, substantially boosting its resources of both metals.

Last year, it spent $1.26bn for a 63% in Serbia’s largest copper mining and smelting complex RTB Bor.

It also trumped Lundin Mining’s (TSX:LUN) earlier hostile bid for Canada’s Nevsun Resources, gaining access to yet another Serbian asset — the Timok copper and gold project. With the move, it also secured ownership of the Vancouver-based miner’s flagship operation, the Bisha copper-zinc mine in Eritrea.

The world’s largest gold company, Newmont Goldcorp (NYSE: NEM)(TSX: NGT) said in a separate statement that it would support Zijin’s bid to acquire Continental by selling its 19.9% equity stake in the Canadian miner and its convertible bond for $260 million.

With the announced sale of Red Lake for $375 million, the mining giant said it expected to realize $635 million in total cash proceeds when the transactions close in the first quarter 2020.

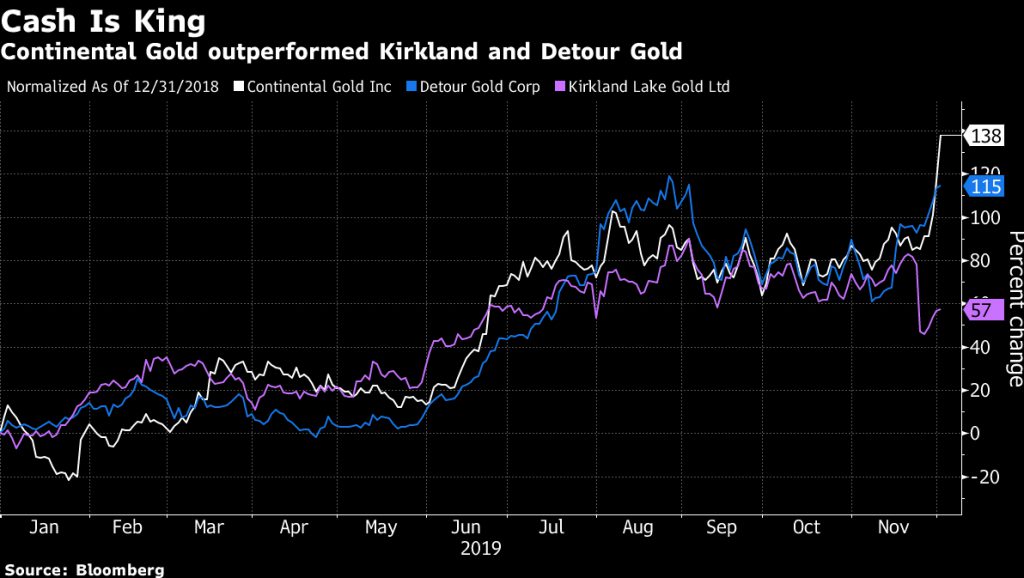

Zijin’s offer for Continental marks the latest deal in the gold sector. Last month, Canada’s Kirkland Lake Gold (TSX, NYSE: KL) (ASX:KLA) launched $3.7bn all-share bid for rival Detour Gold.

The transaction increases the already large list of mergers and acquisitions to have swept the sector this year, kicked off by the highly publicized multi-billion mergers of Barrick – Randgold and Newmont – Goldcorp.